Tax Rules

Table of Contents Show

Managing Tax Rules

NOTE: For information on setting up Tariffs, please refer to Managing Tariffs below.

AbleCommerce uses your tax rules to determine the requirements of a tax and to accurately calculate the amount of tax for an order. Each tax rule applies to a specific location that you define by creating zones. Each tax rule has a single rate applied. The tax rule is then associated to a tax code, and the tax code is associated to a product. A tax code can be applied to products, shipping charges, or gift wrap.

If the order contains any items with a tax code assigned, each rule of the tax code is checked against the user's shipping or billing address to see if there will be any taxes applied to the order. If the tax rule applies to the order, then all products, shipping, or gift wrap charges are checked separately for taxability and rates are applied accordingly. For less confusion, product, shipping, and gift wrap taxes are combined into a single line item for each tax rule.

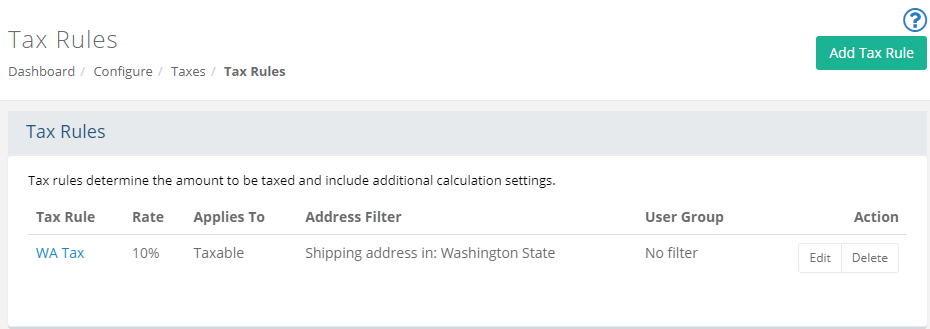

From the menu, go to Configure > Taxes > Tax Rules to view a page similar to the one below.

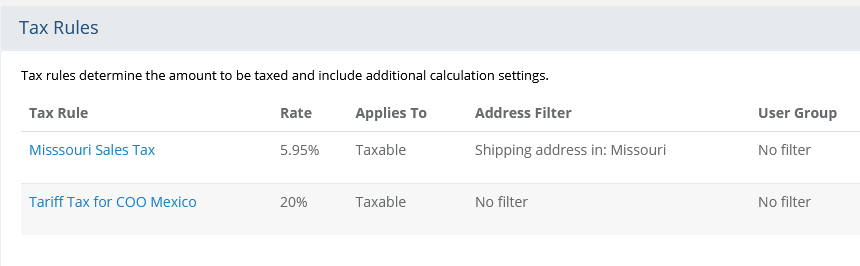

The Tax Rules listing page is shown.

The Tax Rule column lists the name of all tax rules that have been created regardless if they are in use or not.

The Rate column indicates the percentage that is used to calculate the tax rate.

The Applies To column indicates the name of the Tax Code that the rule corresponds to, where the Tax Code is assigned to items in the catalog.

The Address Filter column shows whether the rule is based on shipping or billing address and any designated geographical region, such as state.

The User Group column indicates the membership groups that the tax rule will explicitly apply to when calculations are being made for a registered user placing an order.

The Action

column allows you to Edit

the name of the tax rule, or Delete

the tax rule.

NOTE: Before setting up tax rules, you should have already defined geographical regions, or zones, so that you can specify where your tax rule will apply to.

Add or Edit a Tax Rule

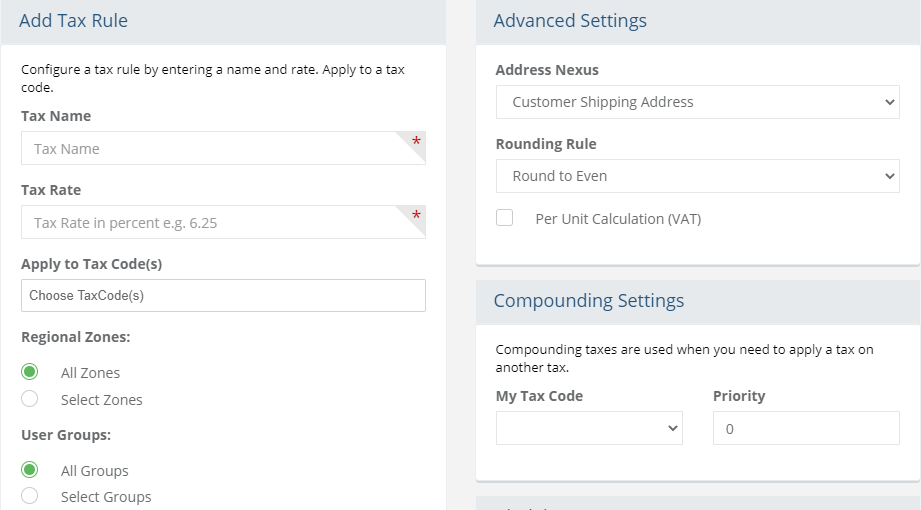

From the upper-right corner, click the Add Tax Rule button to view a page similar to the one shown below:

In the left section, Add Tax Rule, the most common settings are available for configuration. Enter a Tax Name to describe the tax rule calculation. This information will be shown to customers if taxes are applied to their order.

Enter the Tax Rate in percent form. So, if the tax should be calculated at 0.10, then enter "10" for 10% percent.

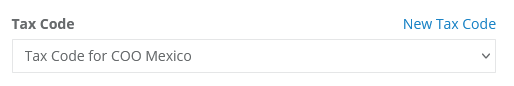

Select a Tax Code. You may have more than one tax code, but that is not common. You can have several tax rules that apply to a single tax code. The tax codes are created from the Configure > Taxes > Tax Code page.

The Zone will define when calculations will take place. This is the geographical location where the customer's shipping or billing address occurs when orders are placed. For more information about defining Zones, please go to Zones for further details.

If the Tax Rule has one or more defined User Groups, then it will only be used for the tax rule calculation for customers that are members of the group(s) specified. If more than one group is selected, then the calculation will apply to any customer who is a member of any group listed.

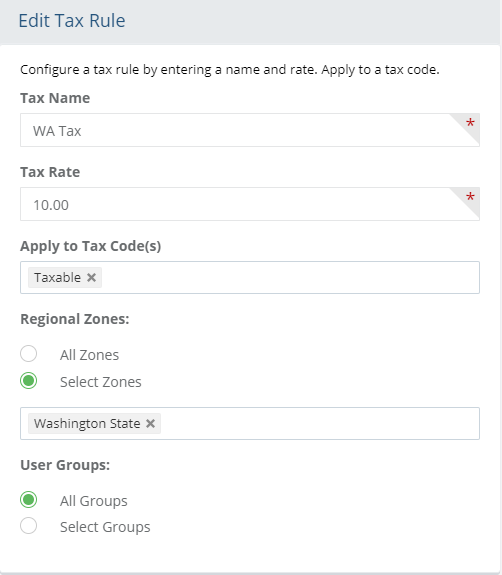

Tax rules can be changed at any time by using the Edit button located in the Action column of the main Tax Rules listing page.

When finished creating or editing a tax rule, press the Save or Save and Close button in the lower-right corner of the page.

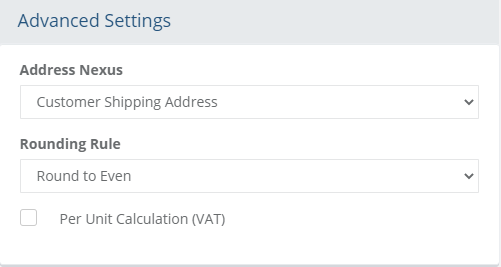

Advanced Tax Settings

Within the section, Advanced Settings, you will see a selection on the page called Address Nexus. This option allows you to choose whether the customer's billing address or shipping address will be used to determine the taxable region. The default value is to use the customer's shipping address.

NOTE: You should consult your local tax authority before changing this option.The Rounding Rule selection has 3 options available:

Common Method - rounding to the nearest decimal, where .5-.9 will round up (e.g. 4.555 >> 4.56) and .0-.4 will be round down (e.g. 4.554 >> 4.55)

Round to Even - this is the default rounding method in AbleCommerce. If the second to last digit is equal to 5 and followed by a nonzero digit, then round up (e.g. 2.5351 >> 2.54). If the second to last digit is equal to 5 and followed by a zero, then look at the last digit. If it is odd, then round up (e.g. 2.5350 >> 2.54). If it is an even digit, then do not round (e.g. 2.5250 >> 2.52)

Always Round Up - similar to the Round to Even, this rounding rule will always round up when the second to last digit is equal to 5 (e.g. 2.5250 >> 2.53)

The checkbox for Per Unit Calculation is a feature specific to VAT (Value Added Tax) where the product price is shown with tax included. This is typically an international feature where some countries require taxes to be shown in advance of checking out. In this case, the user shopping may be viewed as a guest since they are not logged in. If this happens, the store will calculate the tax based on the store's default warehouse address. If the user is logged in and has an address known by the store, it will be used to calculate the tax amount.

After making changes, press the Save or Save and Close button in the lower-right corner of the page.

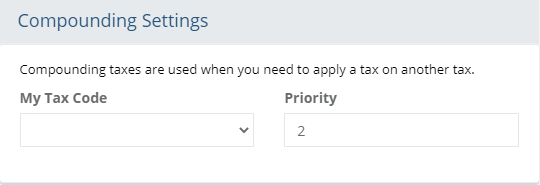

Compounding Taxation

In the special case of compounding taxes, or where tax is calculated on tax, there is an option to select another tax code that should be used to charge tax on the selected tax rule. Compounding taxes are used in Canada, so we provide an example of how this can be setup in AbleCommerce.

Setting up Compounding Tax (example)

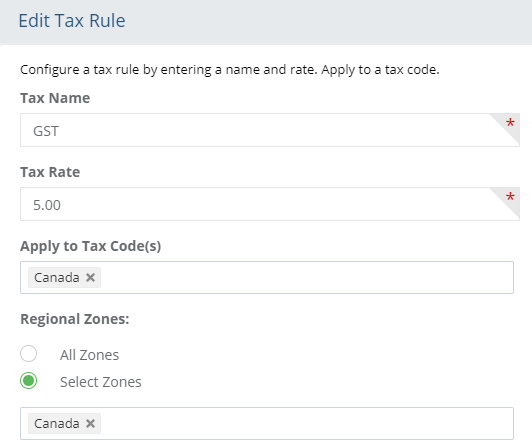

Create two tax rules with both of them applied to the same Tax Code. For the first example, we use GST tax for the name and tax code that identifies the products falling under this taxation. Make sure to select a Zone that can be used to apply the tax to each order.

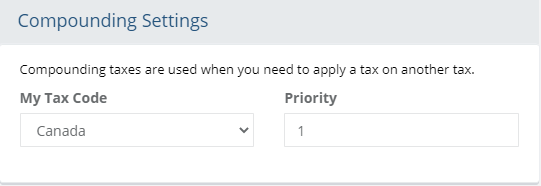

Within the section named Compounding Settings, select the tax code that will be taxable. Also, set a priority of 1 to indicate this tax rule will be taxed on.

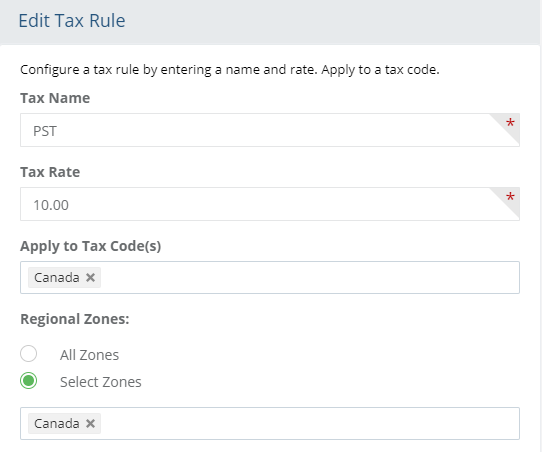

For the second example, create a second tax rule and give it a name such as PST with a rate. Make sure to apply it to a tax code and zone as before.

In the Compounding Settings section, the priority will be 2 instead of 1. It's not necessary to apply a Tax Code in this section.

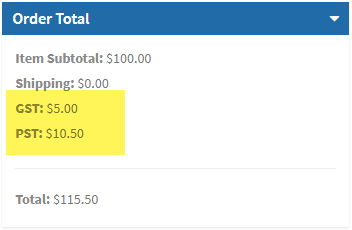

On checkout, for any address that applies to the tax rule, here is how the taxes are calculated for a product priced at $100.

In this example, note the PST tax rule (10%) is being applied to the GST tax amount of 5%, calculated as $5.00, for the product price of $100.

Managing Tariffs

Under the current Trump regime, tariffs are being imposed on goods purchased from many countries. The tariff can be specific to a product type and based on the country of origin (CoO). AbleCommerce can easily support the new tariffs using tax codes and tax rules. If your plan is to pass on the tariff to your customers, it can be done within AbleCommerce by creating new tax codes. We have outlined the steps below:

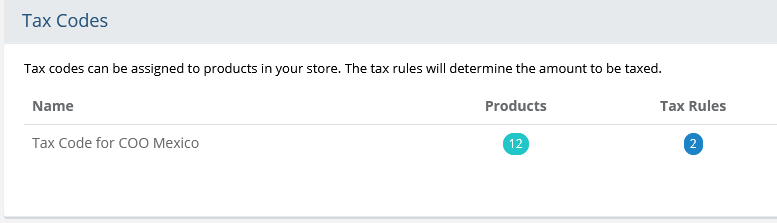

STEP ONE: Create a Tax Code for each Country of Origin

The first step is to determine which products have the same country of origin and what the tariff rate will be.

Create a new Tax Code in AbleCommerce for each country of origin.

Name the Tax Code accordingly so it will be identifiable by CoO. The name is for internal use only.

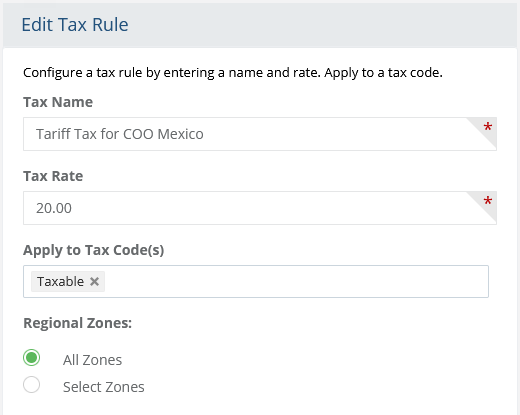

STEP TWO: Create a Tax Rule that uses the applicable rate for the Country of Origin.

The next step is to determine the percent rate for the tariff and name it accordingly. The name will be displayed to customers.

It is not necessary to apply the tax rule to any specific location (zone) as this is calculated for each product that the tax code is assigned to.

STEP THREE: If you have existing tax rules, apply those for each new tax code.

Let's say, for example, that you have a state sales tax for Missouri. To make sure the existing sales tax is calculated along with the tariff, you will need to copy the tax rule and make sure it is assigned to each new tax code.

STEP FOUR: Apply the tax codes to the products based on country of origin.

When you apply the Tax Code to a product, you are able to get a specific tariff rate applied to a product that originates in a country.

Applying tax codes to products can be done in a number of ways.

Edit the product individually to assign a tax code (as shown above).

Use the Find and Assign page to search for products and assign the applicable tax code.

Use Product Batch Edit to update several products at once.

Use the Product Import with a CSV file to update all products at once.

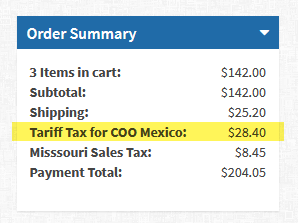

FINAL RESULT

Upon checkout, the customer will see the tariff calculation for the product(s) purchased. If there is a second sales tax, that will be applied as normal.