Avalara AvaTax - Tax On Demand Service

Table of Contents Show

Introduction

AbleCommerce provides a certified AvaTax integration which is fully integrated and ready to implement with your Avalara tax service.

When implemented, the integration will provide tax calculation services through AbleCommerce using the Avalara AvaTax service. It is a full featured integration that includes tax calculation and address validation. It is compatible with all major features of the AbleCommerce shopping cart, for example, quantity discounts, shipping charges, tax exempt accounts, and multiple origin/destination addresses.

The AvaTax service must be purchased separately from Avalara.

.png)

Features

No one likes dealing with sales tax.

Sales tax isn’t core to your business and should be automated. You may be doing it wrong, exposing your business to unnecessary audit risks, and don’t even know it.

Doing sales tax right is simple with Avalara.

We do all of the research and automate the process for you, ensuring that the system is up-to-date with the most recent sales tax and VAT rates and rules in every state and country, so you don’t have to. As a cloud-based service, AvaTax eliminates ongoing maintenance and support. It provides you with a complete solution to manage your sales tax needs.

Address Validation included

Rooftop Accurate Calculations

Product and Service Taxability Rules

Exemption Certificate Management

Out-of-the-Box Sales Tax Reporting

And, we can even do the filing for you!

With an integration to AvaTax, AbleCommerce customers can be up and running quickly. Join over 11,000 businesses who use the leader in sales tax automation … and do sales tax right. For more information, please visit http://www.avalara.com or call their toll free number at 877-780-4848 to get started.

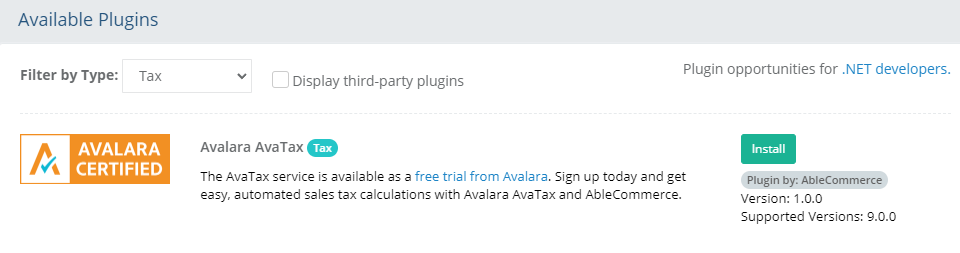

Installing the AvaTax Plug-in for AbleCommerce

Login to your AbleCommerce installation.

Using the menu, go to the Plugins page.

Use the Filter Plugins option and select the type "Tax".

Note: Avalara AvaTax will be shown in the list as shown in the screenshot below.

Click the green Install button in the far right column.

When the confirmation popup appears, click the green Yes, install it button.

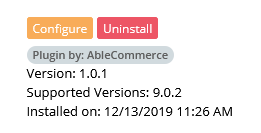

Upon completion, click the orange Configure button.

NOTE: Version shown may be different depending on the release of AbleCommerce you are using.

Configuring the AvaTax plugin for AbleCommerce

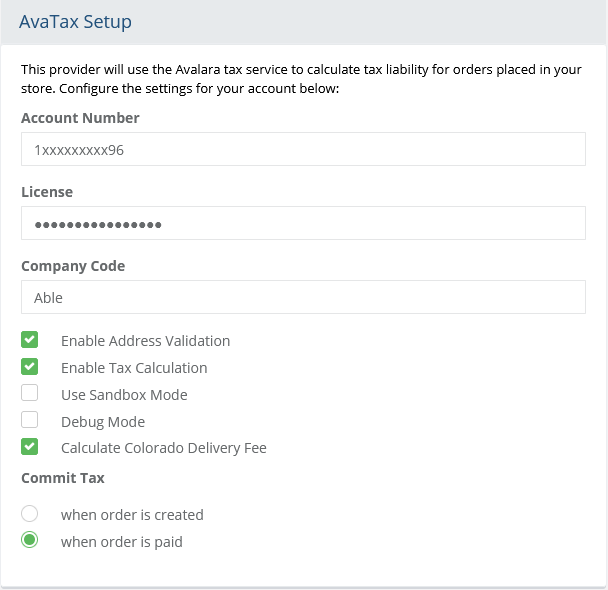

Before you begin, make sure that you have your AvaTax Account Number and License Key, both of which are provided with your Avalara AvaTax account.

From the AbleCommerce Admin menu, go to the Configure > Taxes > Providers page.

You will now be on the configuration page for Avalara - AvaTax.

In the field named Account Number, enter your AvaTax Account number here.

In the next field, enter your AvaTax License Key.

The Company Code field is required as of version 9.0.11. This is used for any post-order operation, such as recalculating taxes on an existing order.

(Not shown in the screenshot above) For versions 9.0.0 - 9.0.6 only: The Tax Service URL is pre-populated with an AvaTax URL provided for testing and development purposes. You will want to change this to the production URL once testing is complete.

Development URL: https://development.avalara.net/Tax/TaxSvc.asmx

Production URL: https://avatax.avalara.net/Tax/TaxSvc.asmx

The Address Service URL: https://avatax.avalara.net/Address/AddressSvc.asmxThe Enable Address Validation option is checked by default. If you only wish to use the Tax Calculation services, then uncheck this box.

The Enable Tax Calculation is checked by default. If you only wish to use the Address Validation services, then uncheck this box.

For versions 9.0.7 and higher only: Check the Use Sandbox Mode box if you are using a sandbox account. Uncheck if the account is production.

Debug Mode is an optional feature and should only be enabled at the direction of AbleCommerce support.

For versions 9.0.7 and higher only: Check the Calculate Colorado Delivery Fee box if you are a merchant that is required to collect this tax on shipments to Colorado.

NOTE: A new retail delivery fee took effect in Colorado on July 1, 2022. Retailers will have to collect the $0.27 fee every time they deliver taxable goods to a Colorado address. For more information, go here: https://tax.colorado.gov/retail-delivery-fee to see if you need this option enabled.

This fee applies to each order that has tangible taxable items being shipped to Colorado, regardless of the number of shipments going to Colorado. The fee can be excluded if you qualify, but it is best to contact the State of Colorado to confirm before enabling this option.Click the SAVE button.

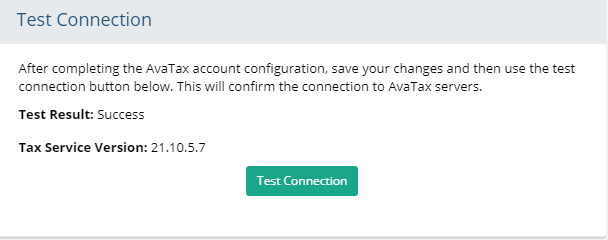

To confirm your account is connected, use the Test Connection button and make sure there is a "success" result.

NOTE: In AbleCommerce version 9.0.7, the AvaTax integration was upgraded to use Avalara's Rest API v2. When testing the connection, the Tax Service Version shown will be 22.9.0 for versions 9.0.7 and higher.

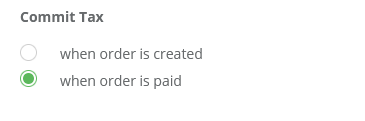

Commit Tax

From the configuration page, there is a setting to determine when an order with taxes is committed to Avalara. It is important to understand the difference in behavior before selecting this option.

Commit Tax when order is created -

The order is created with an authorized payment, fully paid, or no payment.

Order information with taxes sent to Avalara.

After the order is placed, if the taxes are recalculated and adjusted, the updated order and tax information is sent to Avalara.

Commit Tax when order is paid (if payment in full)-

The order is created and paid in full (e.g. credit card captured).

Order information with taxes sent to Avalara.

After the order is placed, if the taxes are recalculated and adjusted, the updated order and tax information is sent to Avalara.

Commit Tax when order is paid (if payment authorized or not fully paid when placed)-

The order is created with an authorized payment or no payment.

Order is placed without committing taxes to Avalara.

From admin, the payment is captured from a pending authorization or paid from another method.

Note: When the payment is completed, the taxes for the order are calculated and committed to Avalara. If there are changes to the order items, address, or user, before the payment, then the calculation could change the tax amount on the order. This could result in a balance due or credit, so make sure to review the order amounts in AbleCommerce if changes have been made.Order information with taxes sent to Avalara when the order is paid in full. Payment Status: Paid

After the order is placed, if the taxes are recalculated and adjusted, the updated order and tax information is sent to Avalara.

IMPORTANT:

Always recalculate taxes

after adding items, removing items, or changing the shipping on

an existing order. This will ensure accurate tax collection and

reporting. In version

9.0.10, the recalculate tax function will update the transaction

within Avatax to reflect the date/time of the recalculation. This

ensures that tax amounts reflect the time of current order changes,

instead of when the order was initially submitted to Avatax.

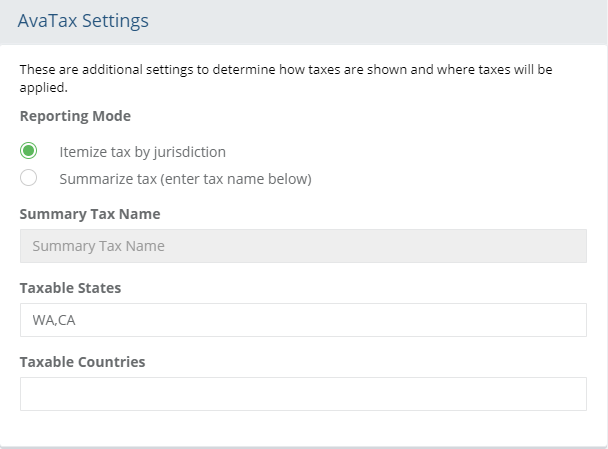

AvaTax Settings

Next, you need to choose the tax display settings. Review the AvaTax Settings section shown below.

First step is to choose the type of Reporting Mode. This determines how the taxes will be shown during the checkout process.

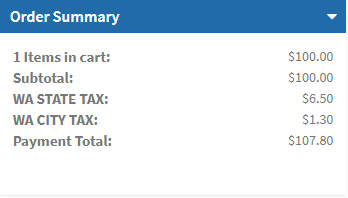

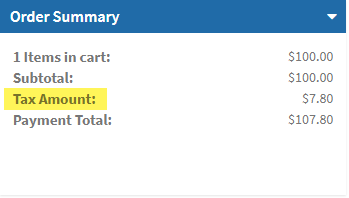

Itemize tax by jurisdiction: In this mode, tax line items are broken down by jurisdiction and recorded using the tax name provided by the AvaTax service.

Summarize tax: In this mode, the total calculated tax is created in a single summary line item, using the tax name specified in the Summary Tax Name field.

In the Taxable States field, you may enter the 2-digit state code if you only want taxes calculated for orders within individual states. Leave this field blank to have AvaTax calculate taxes for all supported states and/or provinces. To include individual states/provinces, enter them in a comma delimited list using the 2 letter state/province code. e.g. WA,OR,CA,TX

In the Taxable Countries field, you may enter the 2-digit country code if you only want to use address validation services for particular countries. Leave this field blank to enable address validation for all supported countries. To include individual countries, enter them in a comma delimited list using the 2 letter country code. e.g. US,CA

At the bottom of the page, click the SAVE button.

NOTE: The Reporting Mode tax setting will also determine how the Colorado delivery fee will be shown. If taxes are itemized, the delivery fee will appear on the invoice as a separate non-shippable item. If taxes are summarized, the deliver fee will appear within the Order Summary section.

Usage and Configuration

Within your Avalara AvaTax dashboard, you have two choices for integration with the AbleCommerce product catalog. You can choose to use item codes or tax codes, or some combination of the two.

If you want AvaTax to tax all items using the correct tax rates, then it is not necessary to map all products. Avalara will tax all orders appropriate to the states you are collecting tax for.

Integrating with Item Codes

Within the AvaTax dashboard, you can define your catalog items and indicate what tax code they should correspond with. In the figure below, the area circled in red (to the left) is the item code. The area circled in green (to the right) is the tax code that will be used by AvaTax for this item.

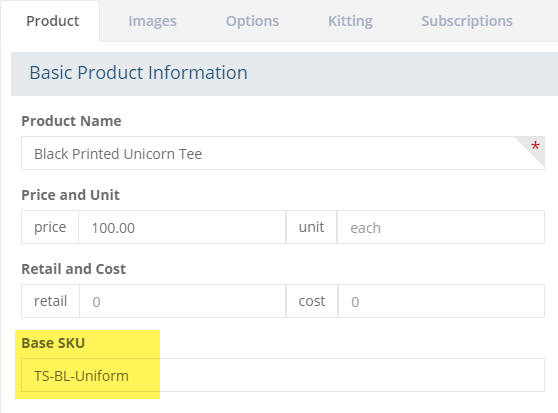

Now for the corresponding item in the AbleCommerce catalog, you

must set the SKU field to the same as the item code. This is shown

highlighted in the figure below:

When this link is established, anytime the item is Black Printed

Unicorn Tee purchased, AbleCommerce will tell AvaTax the item

code of TS-BL-Unicorn. AvaTax will find the item code defined

and map the product to the tax code PC040200. From there, the

appropriate tax rules can be applied by the AvaTax service.

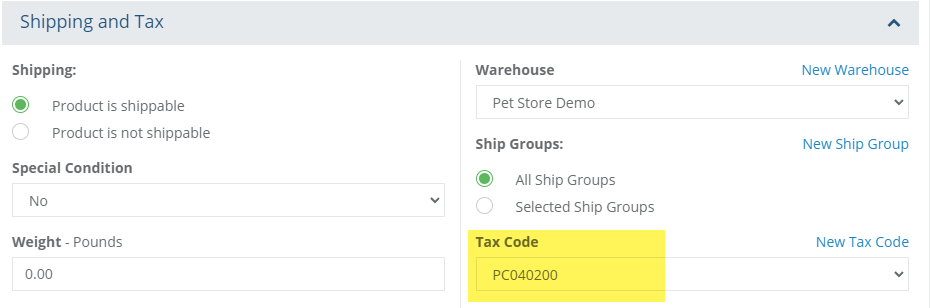

Integrating with Tax Codes

If you do not define your items within the AvaTax dashboard,

you can also tell the tax service what Tax Code to use for a product

directly. To do this, you must first configure the tax code within

AbleCommerce. Access the tax codes screen by going to Configure

> Taxes > Tax Codes from the AbleCommerce merchant menu.

In the example figure above, the Add Tax Code pop-up shows PC040200

being added. Once the code is added here, it will be available

when adding or editing products and services in the AbleCommerce

catalog. To associate the tax code, edit the product and simply

make the correct selection in the drop down:

After this association is made in the AbleCommerce catalog, the

value of the tax code will be submitted with the order data submitted

to the AvaTax service. The selected tax code will be used in applying

tax rules.

Using Both Item Codes and Tax Codes

You can use either method for connecting AbleCommerce products to the AvaTax tax codes. However, be aware that if a product contains a valid item code (in the SKU field) as well as passes a valid tax code, the item code will take precedence and the tax code will be ignored.

Integration Scenarios

When the service is configured and running, AbleCommerce will communicate with AvaTax in the following scenarios.

Address Validation

Quality address data is crucial to accurate tax calculations. In order to ensure the best results, AbleCommerce implements the address validation services of AvaTax in two key points. When you add or edit Warehouses (the store origination address) within AbleCommerce, the address is validated and standardized. Also, when customers are proceeding through the checkout sequence their billing and delivery addresses are also validated and standardized.

Tax Calculation

When a customer is shopping on the site and proceeds to the checkout phase, taxes for the basket will be calculated and displayed prior to purchase. This calculation process can be repeated many times for a single basket during the shopping session. The recalculation will occur each time the checkout is initiated.

Tax Committal

When an order is finally submitted, the tax document is finalized with AvaTax. This saves the tax document to your AvaTax sales history and will show up on reports.

Tax Cancellation

If an order is cancelled within the AbleCommerce merchant interface, the AvaTax service is notified if the order included any calculated taxes. This way you will not incur any tax liability for orders that were not valid.